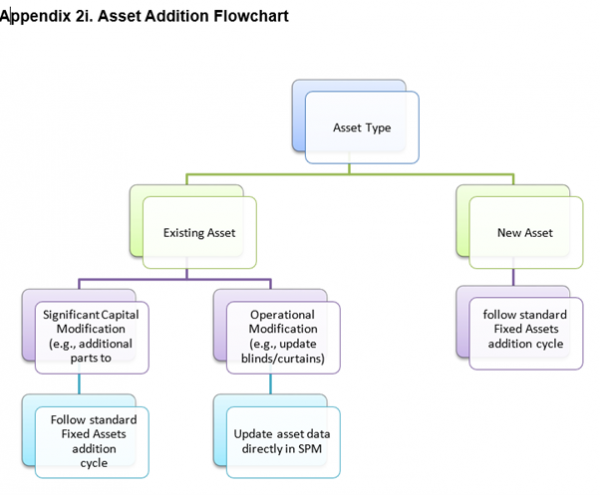

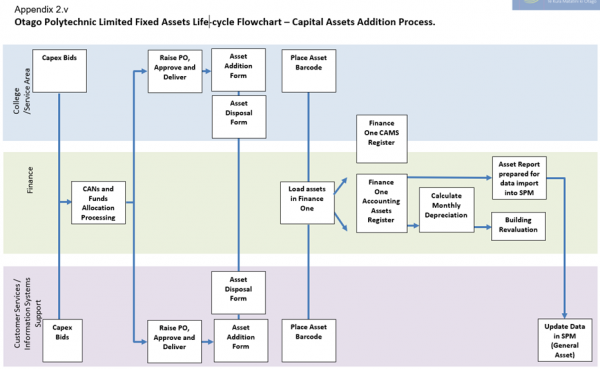

Purchase of Assets (refer to Appendix 2i and 2iii.).

1.1 All purchases of assets should be included in the current capital expenditure budget or reforecast approved by Te Pūkenga Council. Te Pūkenga Delegations Policy policy sets out the circumstances and procedures whereby unbudgeted assets can be purchased (only allowed if approved by the Deputy Executive Director: Operations prior to the purchase being made).

1.2. Purchases must be made in accordance with the Te Pūkenga Procurement Policy and Procurement and Purchasing Policy Te Pūkenga Aligned.

1.3 All approved fixed asset (capital) purchases must have a five-digit Capital Approval Number (CAN), assigned by either the Financial Services, Information Systems and Support (ISS) or Campus Services.

1.3.1 The CAN number is used for the analysis code part of the account number, on the items purchase order. Once the purchase order is approved and physically received the order must be receipted in Finance One. After the purchase is receipted, an Asset Additions Form must be completed (refer to Appendix 2iii)) and sent to Financial Services.

1.4. Finance will:

1.4.1 Load the asset into the Fixed Asset Register.

1.4.2 Assess if the asset needs to be loaded into the SPM Capital Asset Management System (land and buildings, and teaching assets greater than $2000).

1.4.3 Contact the College/Service Area to obtain the additional information required for the SPM system.

1.4.4 Forward the details to the SPM administrator for them to be entered.

1.5 All assets must have a barcode number allocated (generally by Financial Services) and forwarded to the College/Service Area for attachment to the asset. The exception is assets purchased by ISS and Campus Services who allocate their own barcode number and advise Financial Services. The barcode number becomes the unique identifier for the life of the asset.

1.6 If the asset purchased replaces an existing asset, the existing asset must be disposed of in line with the following disposal of assets procedures. Refer to Appendices 2ii and 2iv).

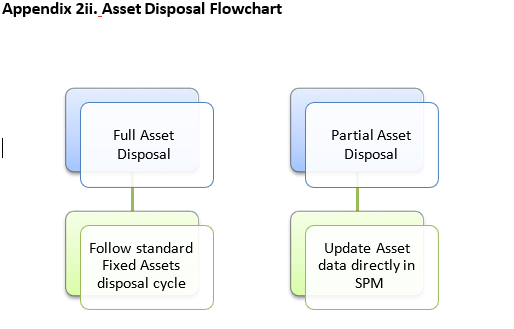

2 Disposal of Assets (refer to Appendix 1ii and Appendices 2ii and 2iv).

2.1 Assets may be disposed of for these reasons:

Surplus to current or immediately foreseeable requirements.

- Part of an asset replacement programme.

- Unserviceable or beyond economical repair.

- Technologically obsolete and operationally inefficient.

- A replacement asset has been purchased.

2.2 All monies received from the disposal of assets must be banked into Otago Polytechnic bank account as soon as is practicable (Education and Training Act 2020 and the Education and Training Amendment Act 2021).

2.3 Otago Polytechnic has delegated authority to dispose of assets up to a certain financial limit (currently $50,000). Assets with values above this limit require written consent from the Secretary of Education to:

- Sell or dispose of assets or interests in assets.

- Mortgage or change assets or interests in assets.

- Grant leases of land or buildings.

2.4 Disposal of assets will be carefully managed to ensure the best net value for the asset is realised and completed in an efficient, effective, and transparent manner. All disposals will be appropriately authorised and adequately documented.

The sale price can be either book value or market value as approved by the Director: Financial Service, the Digital : Digital, or the Deputy Executive Director: Operations.

2.5 IT Fixed Assets will not be sold or gifted to employees or recently departed employees of Otago Polytechnic.

2.6. All Otago Polytechnic owned fixed assets will be returned to Otago Polytechnic on termination of their employment with Otago Polytechnic.

3. Recording of Assets

3.1 All assets that exceed the capitalisation threshold (refer to Definitions above) must be recorded on the fixed asset register by the Financial Services and in the SPM system by the delegated SPM administrator in accordance with the SOP, flowcharts, and forms (refer to Appendices 1 and 2).

3.2 Assets are recorded in the fixed asset register for finance purposes and in the SPM asset management system for strategic asset management purposes.

3.3 In the fixed asset register, purchased assets are initially recorded at cost price with the exception of donated items which are recorded at their fair market value.

3.4 After the initial purchase, assets are recorded at cost price less depreciation or at revaluation dependent on the asset class.

4. Asset Stocktake

Physical verification of assets is to be completed in line with the following procedures:

4.1 Colleges and Service Areas are primarily responsible for undertaking verification (stocktake) of their assets and specified items (except for land and buildings). This verification process is to be completed annually.

4.2 Financial Services is responsible for undertaking verification of specified items (except for land and buildings). This verification process is to cover:

- Annual physical verification of assets with a net book value over $50,000.00.

- Bi-annual physical verification of assets with net book value between $20,000 and $49,999.99.

- Tri-annual verification of assets with net book value between $2,000 and $19,000.00.

- Assets with a net book value below $2,000 will not be subject to asset verification.

4.3 The objective of physical verification is to maintain the integrity of the Otago Polytechnic’s Asset Register by:

- Ensuring that all assets held with a net book value over $2,000 are recorded in the register

- Verifying that all assets in the register with a net book value over $2,000 have been physically located and are still functional and in use; and

- Updating the register for unrecorded changes in asset ownership, responsibility, or location.